JOIN THE TAX-FREE WEALTH CHALLENGE NOW! MARCH 18-22 2024!

https://www.thetaxfreewealthchallenge.com/join-thechallenge

Chapters:

0:00 Intro

1:03 Why Add Your Children to Payroll?

3:40 Example: Hiring Your 16-Year-Old Son

4:45 What About S Corps?

6:50 The Fair Labor Standards Act

8:29 Hiring Children Over 21

11:04 Downsides of Adding Your Children as LLC Members

11:37 Things to Watch Out For

13:59 The Maximum You Can Pay Your Children (Without Paying Taxes)

14:45 Outro

Taking the Next Step:

Download the Short-Term Rental Rule E-Book! ▶ https://ebook.taxalchemy.com

Book a Professional Tax Strategy Consultation ▶ https://msgsndr.com/l/UJizByOClF

Watch this FREE Webinar on how to Use Real Estate To Offset W2/1099 Taxes ▶ https://taxreduction.link/taxsaver

Get Help Setting up Your LLC, Now ▶ https://shareasale.com/r.cfm?b=617326&u=2911896&m=53954&urllink&afftrack

Many business owners who have children think about adding their children to their LLCs. However, a lot of these business owners have questions about when they should do this, how they should do this, and whether or not it is even a good idea to add their children to their LLCs in the first place.

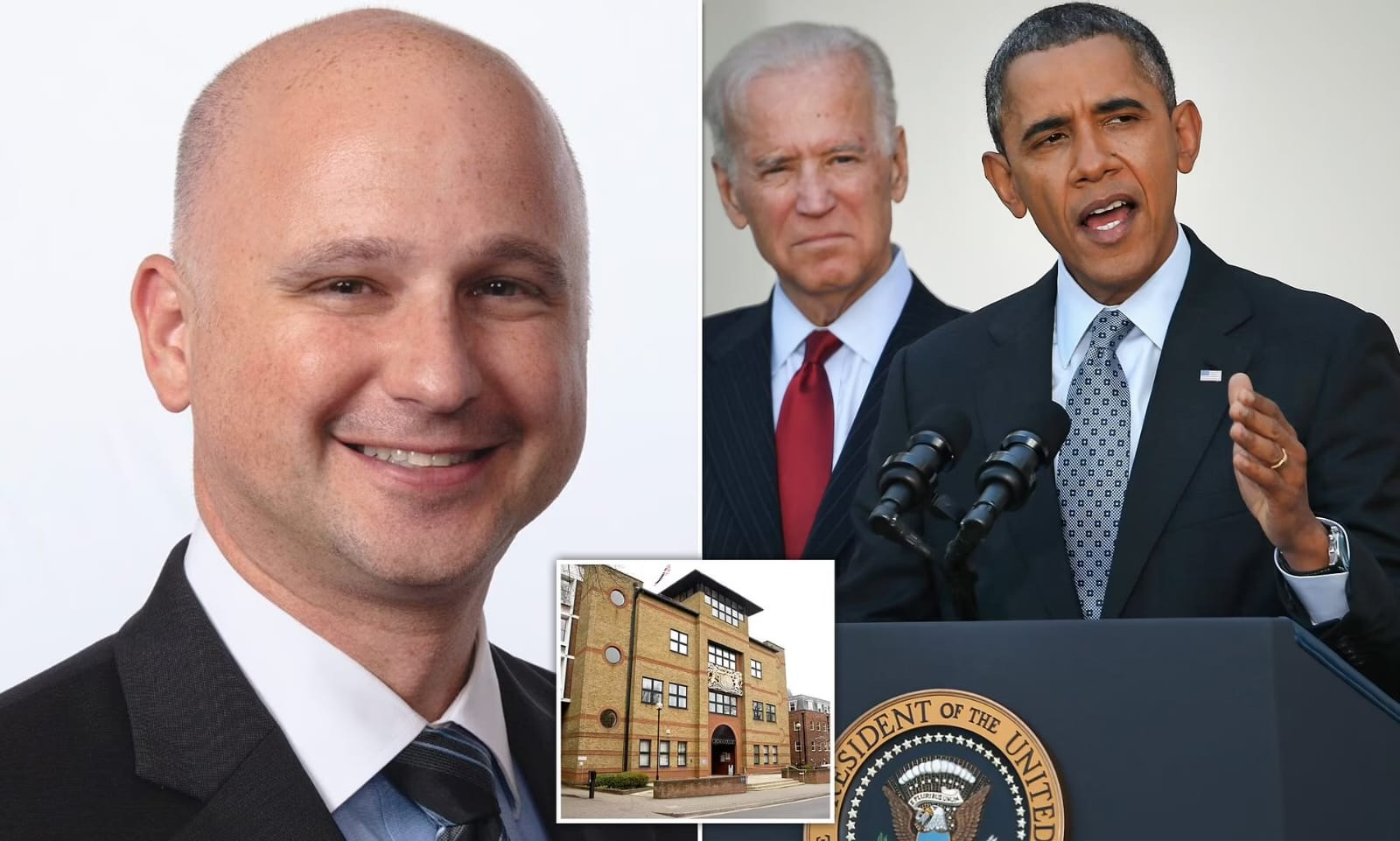

In this video, tax expert Karlton Dennis answers all of these questions and provides additional information about hiring your children as employees in your LLC. For example, he discusses the laws around this topic, the tax advantages of adding your children as employees in your business, and more.

In addition to explaining the best hiring practices for children under 18, Karlton also provides insights into hiring adult children. After all, many business owners are also interested in hiring their children after they turn 18. So, if you are a business owner who is thinking about hiring your children, this is a very good video for you to watch.

*Disclaimer: I am not a financial advisor nor am I an attorney. This information is for entertainment purposes only. It is highly recommended that you speak with a tax professional or tax attorney before performing any of the strategies mentioned in this video. Thank you.

#childrenonpayroll #taxsavings

![Net neutrality restored as FCC votes to regulate internet providers [Video]](https://StartupBusinessReady.com/wp-content/uploads/2024/04/mp_455700_0_wifithumbnail1672775726jpg.jpg)

![Conservative Brazilians laud Elon Musk at rally in support of Bolsonaro [Video]](https://StartupBusinessReady.com/wp-content/uploads/2024/04/mp_450450_0_brasilelonmuskjpg.jpg)